Company formation in Estonia | e-Residency – the FULL guide (2022)

In short, the Estonian e-residency program enables entrepreneurs worldwide to register Estonian company online and manage it remotely using the Estonian digital ID. Company formation in Estonia is a straightforward and smooth process. Estonia is part of the European Union and provides access to the EU market, and is widely considered to be one of the most innovative countries in the world. Estonia doesn’t tax corporate profits, and due to this taxation system has been number one for several years in the OECD tax competitiveness index. You can also find the 5 best industries that benefit from the Estonian e-Residency concept.

Why did Estonia launch the e-Residency program?

While there might be other reasons for the idea’s creators, it’s about international competition, innovation, and of course, politics.

International competition means that countries compete with each other for tax money and investments. Small countries without natural resources have to find a way to lure in investors and businesses. This has always been the case; thus, we have places like Hong Kong, Singapore and Ireland. There are other factors like location, connecting East to the West or location near very big markets where the legal system is not as strong or reliable. Several reasons make jurisdiction a go-to place for setting up the business. This is a very real competition. And if you play it wrong, the country can find itself in various undesirable (black) lists.

I think Estonia has played this game very well. E-residency makes Estonia a Country as a Service type of platform (a reference to SaaS or Software as a Service). E-Residency is a unique mechanism from the marketing perspective, something you haven’t seen before. Of course, suppose Estonia does not fulfil its promise and won’t keep innovating and improving the product. In that case, the unique mechanism becomes a common mechanism, and we’re already seeing other countries launching their replica programs.

In the long run, the countries which can attract entrepreneurs and investments will do well.

Innovation has become part of Estonian DNA. As a nation, we’re very small, with only a 1,3m population. Still, our entrepreneurs have built more Unicorn companies (startups valued at more than $1 billion) than most other European countries with vastly bigger populations. While Estonia has four unicorns, the rest of the Baltic States have 1 (Lithuanian startup), etc. The innovation doesn’t start with entrepreneurs; the Estonian government has digitalised most of the public services:

Estonian e-Residency program was launched in 2014, and in early April 2020, we have around 12 000 Estonian companies registered by e-residents around the world. Moreover, we have over 100 000 e-residents, and e-Residency has helped many online businesses to succeed.

1. Education — Estonia’s e-School application (known locally as eKool). I don’t think younger students and parents would even imagine a life without this. It’s an electronic school management system where all the information about the homework, class schedules, tests, grades etc., is stored.

2. Healthcare — the national ID card has improved the speed, convenience, and cost-efficiency of healthcare delivery throughout Estonia. Almost 100% of prescriptions are issued electronically. We call our doctor, ask for a prescription, which is then stored on our ID card remotely, and we can just go to a pharmacy to pick up the medicine.

3. Voting — We vote mostly online. Some people doubt whether it’s safe, and some think it’s all a conspiracy controlled by the deep state, while most don’t believe in these theories.

4. Digital signatures — Estonians use digitally signed documents whenever possible. Almost all companies are doing business in Estonia sign agreements and documents digitally.

5. Transportation — In 2004, Estonia launched the first eID-based ticketing system for public transportation. So now Estonians only need an id card to take a bus or a train.

6. Tax returns — Almost 100% of Estonians file their taxes online. It’s all automated. This has also allowed minimising bureaucracy and the number of officials that would otherwise need to be employed.

7. Company management —The most interesting part for foreign entrepreneurs. Company registration in Estonia and management, including signing all the papers and making changes in the company, are all carried out via an online portal.

As Estonia already had all the digital services listed above, some innovative folks like Taavi Kotka and his team started to think about how we could export this technology abroad and make it more accessible for entrepreneurs worldwide. I am not sure how these talks usually begin on the governmental level, and I guess there are plenty of doors to run through to get all the necessary approvals and decision-makers on board, but I am glad we did. The tax money e-Residency has generated for Estonia is close to 35 million euros, and the program has cemented Estonian image as a leader in innovation.

Politics is always part of the agenda regarding government programs and services. Estonia has a rich history with its neighbours, good and bad. And because we’re so small, there’s a lack of military power. What can we do to make ourselves bigger, stronger, and more relevant? …get millions of digital residents! So yeah, it’s a matter of national security. This takes us back to entrepreneurs and investors. More there is big companies and investors part of our digital community, who have an influence on the international level, the safer we should be. At least that is the thinking.

What Can You Do With E-Residency?

There are some limitations to what you can do with the Estonian digital card compared to what Estonians can do with it, but that’s irrelevant anyway. There are likely only a few things you want to do with it – forming the Estonian company online and managing it remotely without much of a hassle. This includes submitting the annual reports, accessing the e-tax office, and signing relevant agreements.

As an e-Resident, you can:

- Register and administrate EU company online.

- Access online banking in the EU via an Estonian company.

- Digitally sign documents

- Encrypt documents

- Authorise your accountant in the e-tax office to submit company tax declarations.

- Authorise your lawyer to represent you before the authorities for any licensing purposes, etc.

That’s pretty much all you need to run your Estonian entity smoothly. You have to couple this with a good service provider (accounting and legal support) who is as modern and forward-looking as the e-Residency concept, as you want your support service to focus on digital solutions.

To Who Is E-Residency Meant For?

There are many examples of companies who would benefit from having a cost-effective solution to open and manage a company online and have this opportunity in the otherwise heavily bureaucratic European Union. However, let’s try to look at some concrete use cases below.

- Digital nomads who love to travel and run online businesses. That’s probably the ideal case, as e-Residency gives the needed flexibility, it’s not expensive, and it’s borderless, just as many digital nomads view the world.

- Entrepreneurs who live in heavily bureaucratic countries, such as Spain, France, Italy, China, etc. No line can’t be crossed when creating more work for yet more public servants and officials with unnecessary paperwork and red tape. If I were an online marketer in Italy or Greece, I would not think for a second if I was presented with a choice to use an Estonian company to run my business. It’s a no-brainer.

- Blockchain & crypto companies. Estonia has specific crypto licenses for companies serving clients in that space and a great image as an innovative and modern country.

- Suppose you’re a non-EU entrepreneur and looking to have a place for business in Europe to access the European Union market. Why go through more hustle than required to set up the company and start doing business?

These are some of the ideas and use cases for entrepreneurs who would benefit from using Estonian companies to launch and grow a business in Europe.

How to Apply to become an e-resident?

It’s super easy to apply for the e-Residency. Just follow the steps given below:

STEP 1: Go to the e-Residency website

Go to e-resident.gov.ee and click on the “Apply Now” button you can see in the header.

STEP 2: Fill in the application

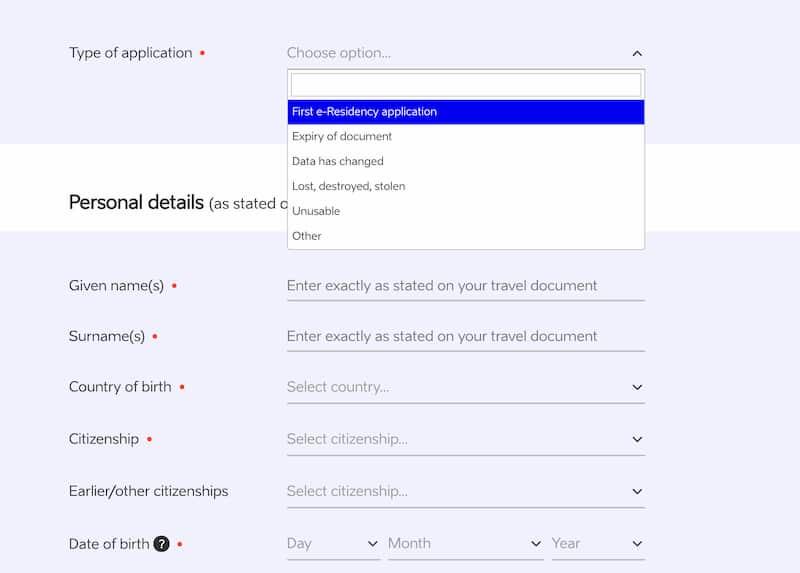

Once you have clicked Apply Now, you will have one more page where you have to create an account. Once you get there, there are standard questions about who you are, where you are from, etc. The application is rather long, and you also have to provide your reason for applying for the digital identity.

P.s. If you have chosen your service provider, you should provide their details; this will speed up the process!

Why the Estonian government wants to know your reason for applying is first to understand the motives of e-residents and decide whether to issue the card to the applicant. Ideally, all approved e-residents would start and run a business out of Estonia.

STEP 3: Consent & Payment

You have to tick unusually many boxes at the end of the application to give your consent on how and what information is processed, etc. Once this is done, you have to click to proceed to the next step and pay the state fee.

Once you’ve filled in the application, including from where you want to pick up your e-Residency card, and accepted all the terms, you can finally click the “Proceed to next page” button at the very bottom of the page.

STEP 4: Wait for the delivery

The final step is to wait for the approval and delivery of the card. This can take anywhere from 4 weeks to 6 weeks in normal circumstances and can take even more in extraordinary times (like the lockdown period of coronavirus).

Before we take a look at how the company can be registered, I just want to say that the physical e-Residency card will be a thing of the past in the future. Estonian authorities are already discussing how to go fully mobile. This would take away the remaining pain of waiting & picking up the e-Residency card physically from embassies or other pick-up points.

How to register a company with the e-Residency card?

Different service providers have streamlined the company formation process to make it less painful and more convenient. Additionally, the authorities are making progress with this as well, and it will get times better once the physical card is no longer needed. At Comistar, we have our own portal to collect the client data, and we’ll do everything on the client’s behalf to make it super simple.

With this tutorial, however, I am going to show what the Estonian company portal looks like and what you can use yourself to start the company registration.

One thing you need to know before you start the Estonian company formation process: You need to have an Estonian legal address and contact person in order to register the company. The legal address is a standard virtual office, and the contact person is mandatory for all Estonian companies managed by e-residents. Most official service providers on the e-Residency marketplace provide this service, including Comistar (to get a quote, please get in touch with us!).

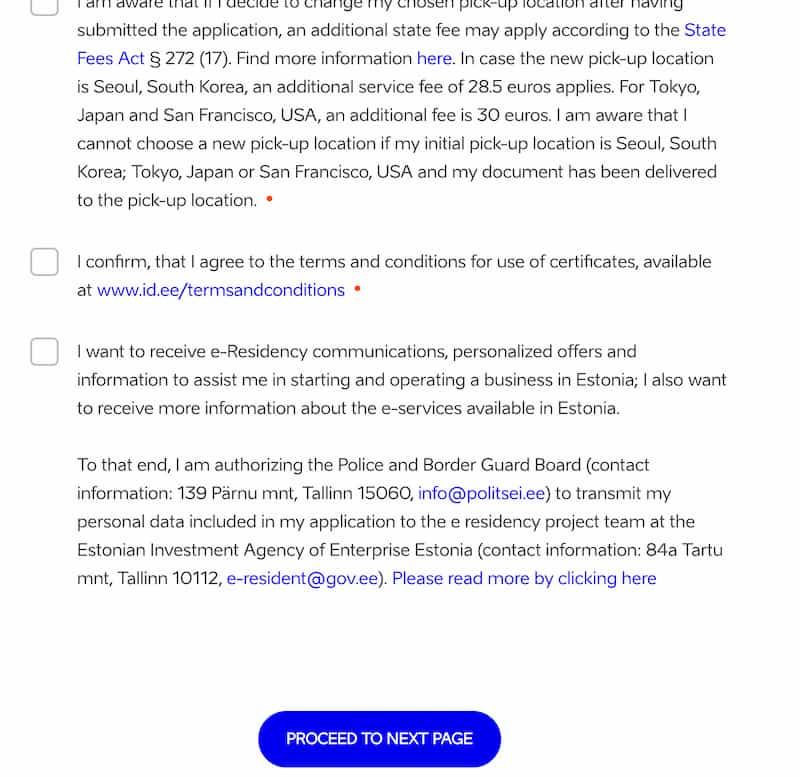

STEP 1: Go to www.rik.ee

Go to rik. ee and choose English on the top right-hand corner. Click on the “Company registration portal”, which is in green colour.

Step 2: Log in to the portal

Click on the only button you can see; it’s hard to miss.

The next thing you will see is a page where you have some instructions and also a Facebook video about the e-Residency program. You have to navigate to the top right-hand corner and find the “Login” button:

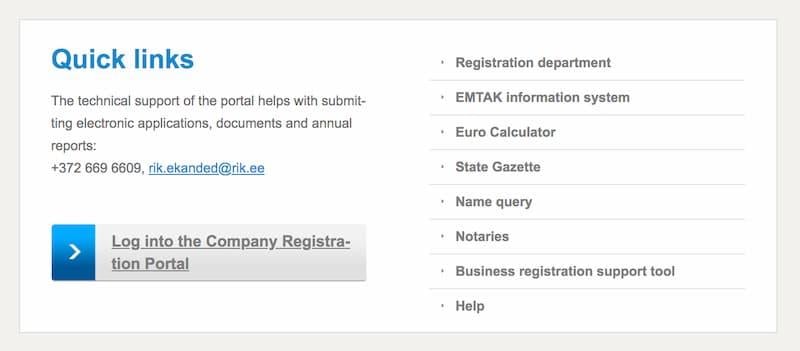

Once you click on the “Login” button, you have different choices of how you’ll decide to identify yourself. If you have a physical e-Residency card, your choice will be an “Estonian ID Card”. However, soon all e-residents can also use Smart-ID to register the company, and we will show you later in this blog post how you can get the Estonian Smart-ID. Smart-ID is more convenient and, in my opinion, more reliable.

The middle option of using the Mobile ID is only available to Estonian citizens with Estonian phone numbers at the moment. For example, the author of this article and many other Estonians only use the Mobile-ID as it’s super convenient.

Step 3: How to start with the Estonian company formation

Once logged in, you’ll see the “opening page” of the Estonian company portal. On this page, you will see all companies that are related to you. In the screenshot below, I show you the navigation bar ( as I have quite a few companies where I am involved as a shareholder, I can’t show my opening page due to privacy).You have to click on the “Submission of application” navigation bar.

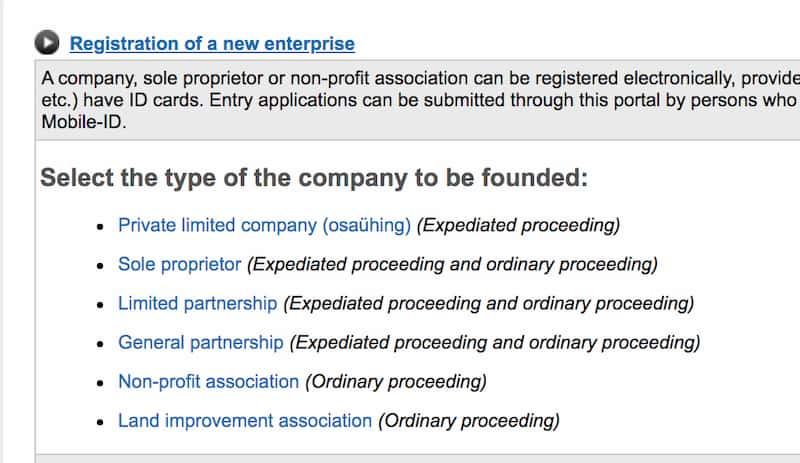

Once you’ve clicked on this button, you will be directed to the page where you have to choose the type of company you’re going to register. Most of you will need to select “Private Limited Company” or “Osaühing” in Estonian. It’s a limited liability company, and I would say 99% of e-residents use this company type to operate their Estonian business.

In some instances, you need to have a different type of company (for example, a Public Limited Company if you want to apply for the Payment Institution License or Investment Firm licenses), or you might want to do a Non-Profit Organization instead.

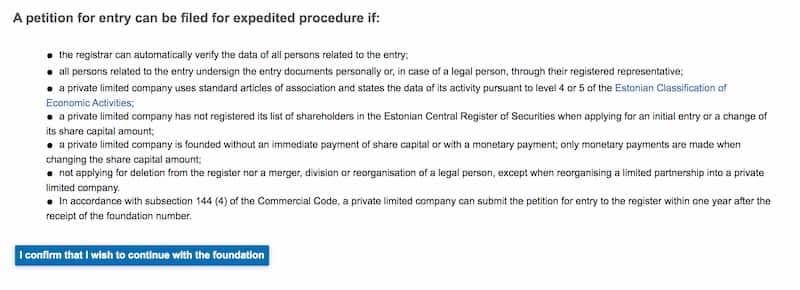

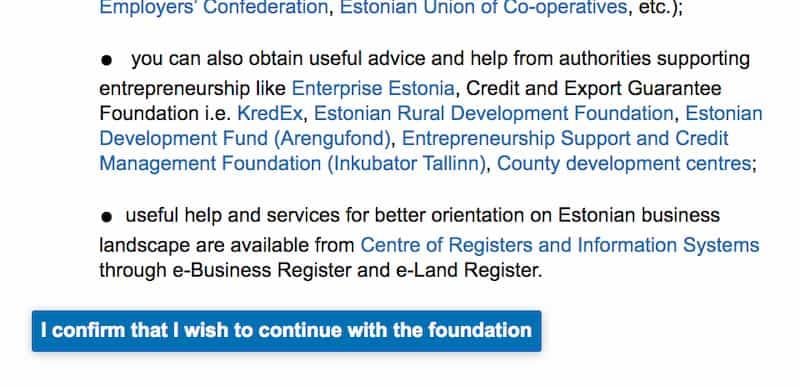

Once you’ve chosen the desired type of the company, you’ll need to give several consents in the row:

The second consent to register the company:

And finally, the third consent to register the company:

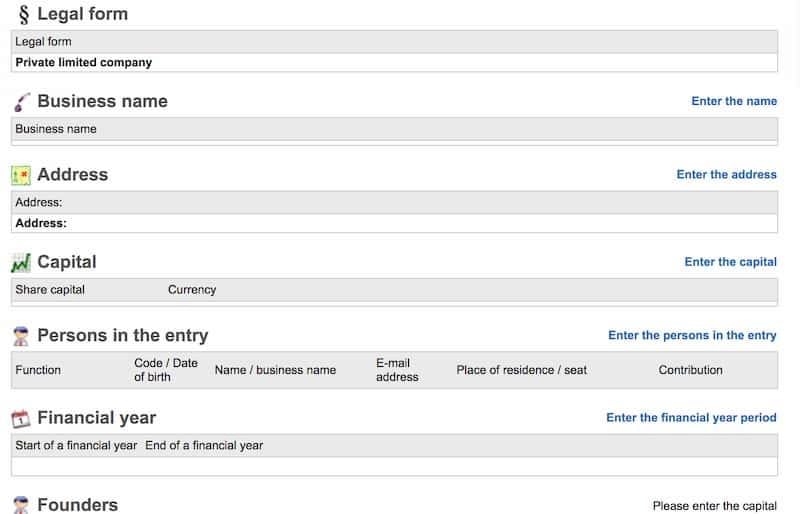

STEP 4: Fill in the Estonia company formation application

Now you’ll see the forms that you will need to fill in. There’s a company name, address, contact person information, management board member, UBO info, description of the activities, share capital, etc. This is the complete form that you have to fill in order to register the company.

Few things to remember:

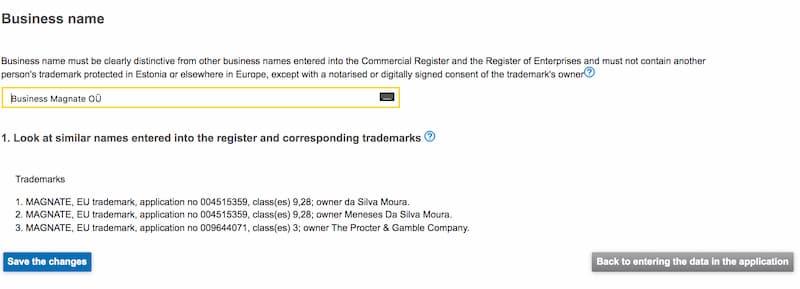

- Company name – check the company name before choosing, as there might be companies with the same or similar names already registered. The system shows you similar names when you insert the desired company name and trademark data. Either way, it’s good to do your research before, and you can also ask your service provider to do that for you.

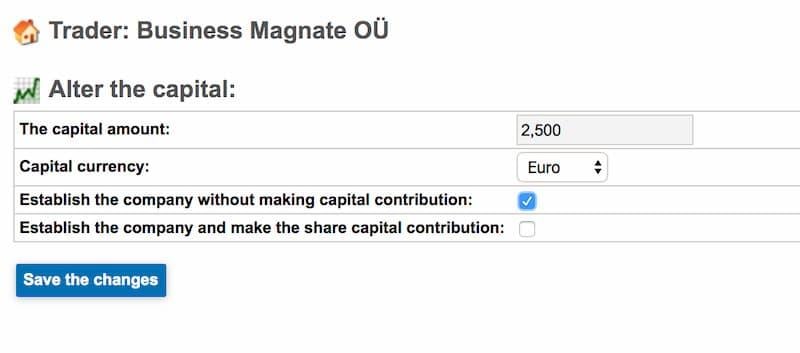

- The share capital minimum is 2500€. When you choose the share capital amount, you can tick the box that you’ll pay in the share capital later. You can choose to pay it within the next three years, for example, 5 or 8, etc.

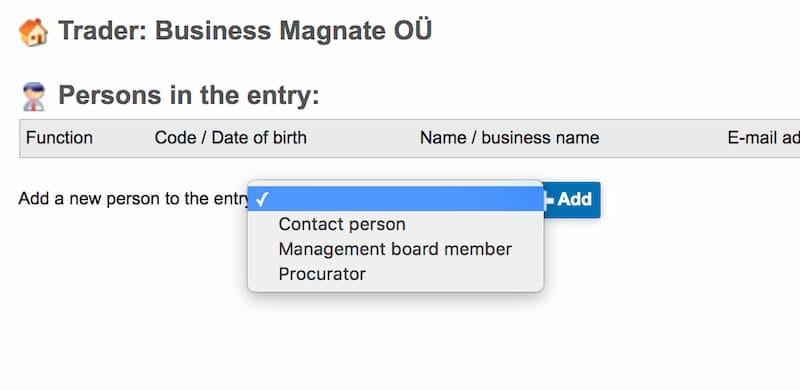

- Most of the things you can do yourself without needing any guidance, for example, choosing the address for your company, as this data is given to you by your virtual office service provider. In the “Persons in the entry” tab, you have to add both the management board member and the contact person (your service provider).

- In the “Founders” tab, you can select “Submit my data” and automatically add your information. The only thing you have to do is enter the amount of share capital contribution. If you’re a sole founder, then you’d need to insert 2500€ (if that’s the chosen share capital amount). If there are more founders, you need to submit the number, which is proportional to the ownership of each shareholder/founder per person.

- The financial year can be from the 1st of January to the 31st of December. This is the easiest for your accountants as well.

- You don’t have to add “Persons outside of entry” unless you require a contact person, as it’s NOT mandatory to have an auditor or a Member of the supervisory board (these are mandatory for Public Limited Companies).

Articles of Association – let’s take a closer look here.

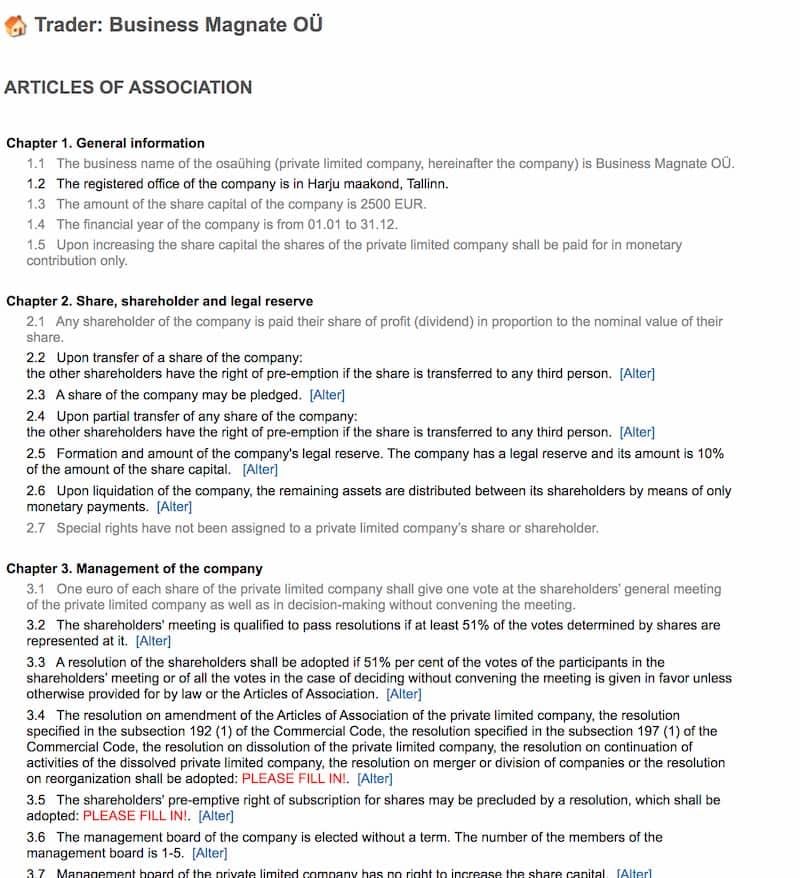

- You will have the standard template of the Articles of Association prepared in the business registry. There are many clauses which you CAN but DON’T has to alter. These alterations can be done according to your preferences, and it’s difficult to give any other general advice except that it’s likely good as it is, especially if you have a one-man company. We do recommend altering the “reserve capital” clause and choose not to have any reserve capital. This will only complicate things in the future from the accounting perspective.

- Below, you can also see some things with the red colour screaming “PLEASE FILL IN”. As you already understood, these are the things you have to fill in by yourself.

While we could take a look at each mandatory “Fill in” clause one by one (and maybe we’ll improve the tutorial in the future by doing that), I think it doesn’t serve you well as it depends on your preference and whether you have one or more shareholders, and whether you expect to have more shareholders in the future, etc.

Going forward…

There are only a few blocks left, like means of communication. You can enter your company e-mail address there, or your service provider may provide a general address to use. This is wise because as soon as your company is registered, there will be a ton of advertisement emails trying to sell services to your new company. It can’t be a random e-mail which isn’t in use, as you need to click on the confirmation link sent to your email.

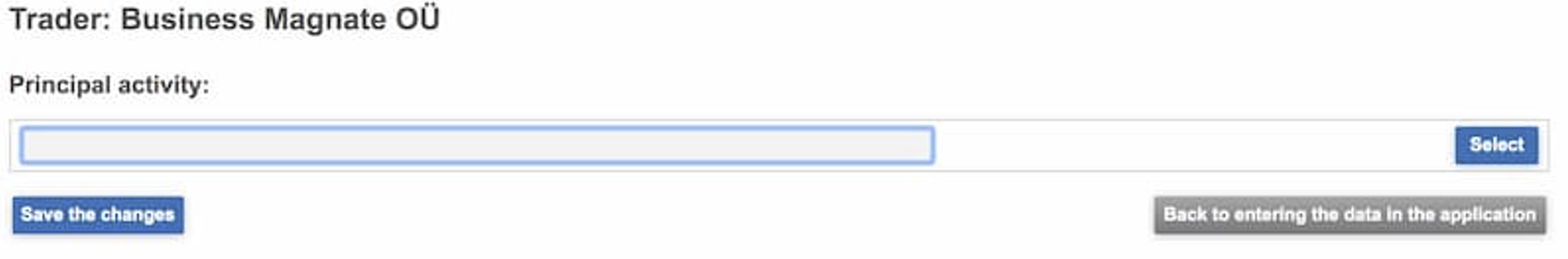

Planned principal activity – this is something we’ll take a closer look at. First, when you start selecting the business activity, you’ll see the following page:

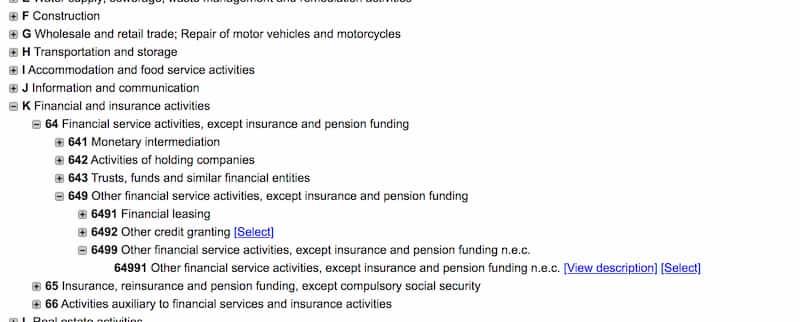

The next step is to click on the blue “select” button on the right, and you’ll be directed to the page where you see different categories and industries. By clicking on the “+” before each category, you can expand it and go into more detail with each category.

Looking at the example above, you can see that by clicking on the “+” couple of times, we get to concrete activity codes that you can choose for your business. If you can see a “select” button next to the code, it means you can click on that, and it will insert this activity code to your Estonian company formation application. You can also view a more detailed description of any given activity.The important thing to understand here is that you probably won’t find the exact description of your business. That’s OK. You just have to pick a category in which your activities fall. You have to choose only ONE main activity, but that doesn’t restrict you from doing other business activities with the company, for example, investing in real estate.

We have just a few last steps now…

There are a couple of optional things like registering employees and registering for VAT. Both of these things can be done after the company is registered via the e-tax office as well. It’s totally up to you. If you know that you will take some time to get the business going and you don’t need the VAT number at this moment, it’s better to postpone as VAT registration means you’ll need to start submitting monthly VAT declarations from the start.

Adding the beneficial owner is mandatory, and it’s pretty easy as it’s likely that you, the founder are the beneficial owner. You can submit your data automatically by clicking “Add” next to your name.

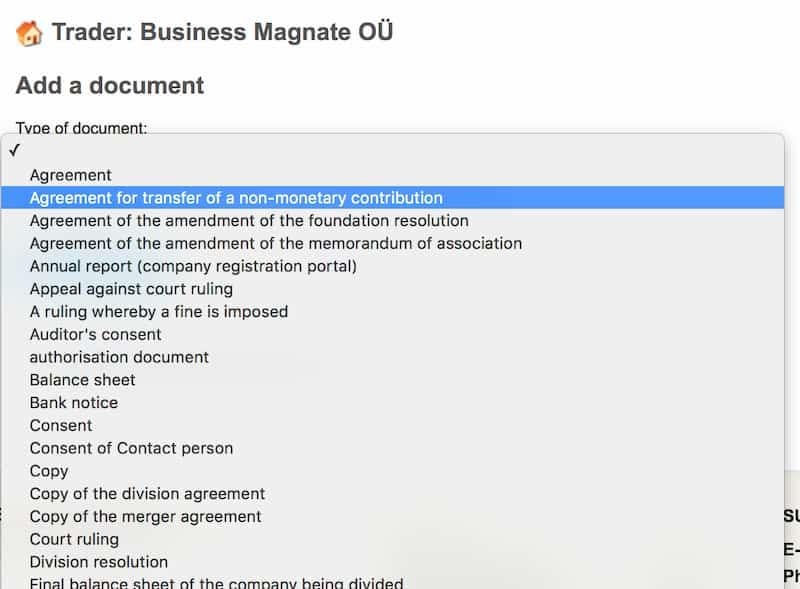

The last tab is for submitting any additional documents. Usually, this is not required, and you can just skip it. However, in some cases, you need to do it. You might want to register the company with a name that you have trademarked before. Then you’ll need to upload the notarised proof of ownership document to the portal, as otherwise, the company formation in Estonia will get rejected.

If you need to add some documents, it’s better to consult with your service provider to make sure you’re doing everything correctly.

As I mentioned rejection, there are a couple of reasons why this may happen. Most of the time, it’s due to issues with the company name – it’s already trademarked, or there are too similar company names already registered. The general requirement is at least a 2-letter difference, but it shouldn’t sound the same, even if it’s written differently.

Another reason for rejection could be not having the contact person or the signature of the contact person. The signing stage comes once you’ve filled in the application and moved on to the next stage.

STEP 5: Confirmation & Signature

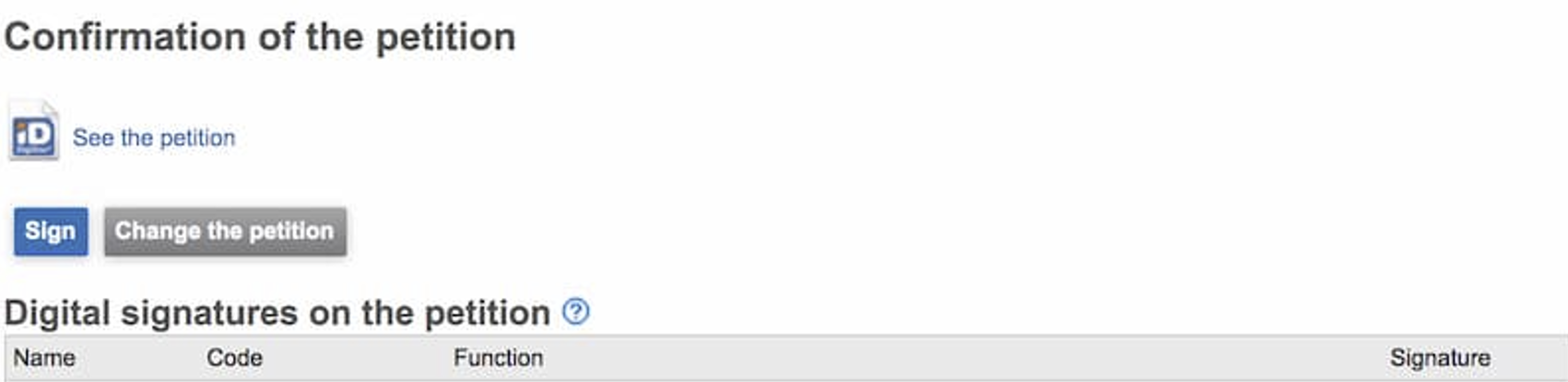

The next step is to confirm the petition of the company.

Once this is done, we’re going to sign the petition. You have to click the blue “Sign” button and use your e-Residency PIN 2 to sign the document before proceeding to the payment.

As it’s likely that you’re a non-resident and you also have a contact person in Estonia (your service provider), you’ll need to wait for their signature BEFORE proceeding with the payment.

Once you’ve signed the company petition, you’re ready for the final step!

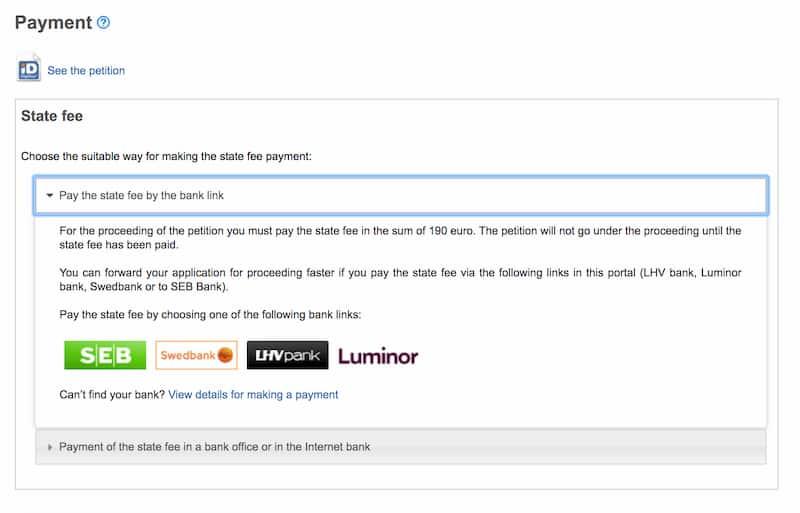

STEP 6: Payment

Almost done! We have just the final step left. First, it’s wise to have your service provider pay that for you, as your service provider has an Estonian bank account and can use the bank links for quicker processing of the petition. It generally takes 1-2 days to have the company registered in this case.

If you don’t want your service provider to pay the state fee for you, you’ll need to make the wire transfer. Wire transfers are slower and require manual work for the business registry to connect the payment and the petition, it can take even two weeks to have the company registered.

Therefore, it’s always recommended to have your support company to pay the state fee and have the company registered quicker with less hassle.

Once the payment is made, you need to click “Submit” on the following page. As I don’t want to register a company with the name “Business Magnates OÜ”, I won’t make the payment and won’t actually register that company. Hence, I can’t show you the last page, but there’s really nothing that can be done wrong.

Next, we’ll take a look at taxation.

Taxation of e-Residents in 2022?

Taxation is always personal, and anything that’s written here shouldn’t be taken as tax advice. I will cover only the most basic tax questions. You can also find a more in-depth article about taxes in Estonia here.

E-residency is not a tax residency.

Many new e-residents confuse e-residency with tax residency. These two are separate things. It’s likely that the e-Residency marketing team didn’t communicate this matter clearly enough initially because, in the past, we’ve seen less confusion about the matter.

E-residency has nothing to do with the tax residency. To become a tax resident in Estonia, you would need to live in Estonia. E-residency is just a tool to open and manage your Estonian business.

Estonia doesn’t tax corporate profit.

Corporate tax does not exist in Estonia. This is true. For years, Estonia hasn’t taxed company profits unless these profits are distributed to the shareholders. This means that companies can re-invest all profits to the business without having to pay tax on that, and I personally think it has been the smartest tax decision Estonian politicians have ever made.

Through the years, our taxation system has gotten a lot of positive media from the international press, and now some countries are replicating our model. That’s good as politicians always think we should tax companies (together with taxing everything else possible) because Nordic countries are taxing companies.

Moreover, Estonia has been number one on the OECD tax competitiveness index for many years in a row. That’s impressive.

There are things to be mindful of, as good as it sounds, which you can read a few paragraphs below.

Salaries & Dividends

Salaries

As a rule, Estonia does not tax the salaries of people who do not work in Estonia. If you pay salary to yourself or you have employees in other countries, you should declare or have your employees declare the salary they receive from your Estonian company in their country of tax residency.

Board member salary taxes can be paid to Estonia. To calculate Estonian employment taxes, you can check out this link and calculate what is the total expense to hire an employee in Estonia on different salary levels.

Dividends

Dividends are taxed at 20% on gross dividends. This means that if you wish to distribute 100 000€ as dividends, then 20 000€ of that will land in the account of the tax office, and you will receive 80 000€.

You can also say that the tax rate is 25% if you calculate the tax on the net amount. 80k paid out means 20k in taxes, which is 25% of the net amount. I will stick to the 20%, as taxes are generally calculated on gross amounts.

VAT

The VAT rate is 20%. Obtaining the VAT number becomes mandatory once you exceed 40 000€ in sales in a calendar year. Here are the basic and general VAT rules:1. Sales to non-VAT registered EU entity or natural person: 20% VAT must be added.2. Sales to VAT-registered EU entity : 0% VAT3. Sales to non-EU entities or natural persons: no VAT is added.As with everything, there are exceptions to these rules, and it’s important to understand where the turnover is created, what type of service/product you’re selling (some niches have lower tax rates as well), etc.

Physical products have different VAT rules, and once you exceed the Member State’s turnover threshold, you need to register and declare VAT in that target market.

VAT number can be obtained via the e-tax office (you can ask your support company and accountant to give you instructions) or at the time of registering the company.

Tax Treaties & Permanent Establishment Rules

Tax optimisation isn’t quite as straightforward as registering a company in a foreign country. Countries have tax treaties with each other, and Estonia is no exception. Therefore, if your only goal is to optimise or even avoid taxes in your own country, then you need a more sophisticated approach.

To give you a quick example: If a German resident establishes an Estonian company, and will continue to reside and work from Germany, then German authorities may state that the Estonian company has a permanent establishment in Germany. The reason is the place of management, or where the company is actively managed.

As a result, the German authorities may tax the Estonian company as they would tax a German company. This is not good, and you don’t want that, as usual, these tax decisions will have an effect retrospectively.

The above example is a simplistic one, and it is more nuanced than that, but the idea was to communicate the risks that you’ll have if tax optimisation is the reason for using e-Residency.

Yes, there are ways to take full advantage of the favourable tax regime of Estonia, but this requires a case by case approach.

During the time we’ve supported our clients in Estonia (7 years), there have been very few cases where such tax issues have arisen from the foreign authorities. It’s not common as the information exchange is not very efficient, and the authorities aren’t usually that interested in small companies because they have bigger fishes to fry.

Costs & Expenses?

Let’s talk about money and how much you’re going to spend to become an e-resident and maintain an Estonian business. The expenses may differ a lot depending on your business and needs, but it’s good to have some basic information to give you an indication.

E-residency card: 120€. Additionally, you may need to pay some tens of euros extra depending on the pick-up location. You’ll have the whole cost structure on the application page of the e-residency card, so it’s all very transparent.

State fee for setting up the company: 265€. This is a one-time payment.

Virtual office + contact person: 200€ – 500€ and more. It depends on the service provider you’re engaging with. It’s a pretty generic service, so it doesn’t matter that much, but mostly it’s about the trustworthiness of the service provider, and you probably want to have one company to give you the whole support – incorporation, accounting, upkeep, legal, etc.

Accounting: again, it depends on the service provider, but to get a good service, I would say from 80€ per month and up. Accounting costs can be a lot more because your needs will change when your business grows. That’s pretty logical, and it won’t be a problem either, as you will have more money to take care of these things. In Estonia, accounting always includes tax reporting.

Legal services: Not a fixed cost and not mandatory unless you have specific needs, but every company needs some agreement or documents at some point in the business lifecycle. Rates in Estonia are generally from 120€/h to 200€/h and even more. This also depends on the complexity of the issue that you need to resolve.

Other costs: There are other expenses to running a business, for example, hosting the website, domain, marketing, and other operational costs which aren’t related to e-residency. If you’re operating in an industry where licensing is required, you have to set aside a budget for licensing fees, additional state fees, local office if it’s part of the licensing requirements, and so forth.

Banking

Banking has been a huge issue for many businesses in recent years, including e-residency companies. Due to several money-laundry cases in Estonia and elsewhere in Europe, the authorities have tightened the AML policies, and banks are made for walking on a very thin line.

It’s understandable, as it’s not cool if hundreds of millions of euros of dirty money go through the system. However, as always, in these cases, the small guys are getting punished as well.

It’s very difficult for companies which are operating internationally, where the manager is a non-resident of the country or if the business doesn’t have a local presence, to open a bank account.

Luckily, the fintech scene in Europe is booming, and there are many so-called online banks that do the trick. You’re not able to get a business loan from them, but you can transact, collect payments and send payments like you can with any business account. The most famous fintechs are (Transfer)Wise (official partner of the e-Residency), Revolut and PaySera.

The e-Residency community

Entrepreneurship can be a pretty lonely ride, and it’s good to be part of something, a community. Over the years, the e-Residency community has grown a lot, and there’s a lively discussion on related Facebook groups, where you can ask and answer questions asked by fellow entrepreneurs.

It’s likely that you’ll find other digital residents of Estonia who can help you with some services, like marketing. Or perhaps clients to your own business, CRM tools, recommendations, etc. It’s a small subculture, and it’s growing bigger and bigger all the time.

Conclusion

To conclude, e-Residency coupled with the Estonian taxation system is clearly one of the better options to start and run your business in the European Union. It doesn’t suit any type of business, for example, if you have a local grocery store, you’re going to have to register a local company.

In our opinion, even online e-commerce might not be the best suited if you have clear markets to where you’re selling. If you plan to sell on Amazon and you’re targeting the US market, it’s likely that a company registered in the US might make more sense.

The same rule applies in Europe, if you’re selling physical products to the German market, you need to declare your VAT in Germany, and using the Estonian company to do that might just complicate things. This is not always the case, but there are things you have to look at before you start.

Estonian e-Residency is still developing. It will be a lot more convenient once we go fully mobile and no physical cards are required. The requirement for the physical card has been the biggest bottleneck for the e-Residency to grow even faster.

All in all, it is one of the best options for running an online business. If you’re ready to hit the start button, we’re ready to help you to get started and build a successful e-Residency company together.

And one important amendment that came into force on the 1st of August, 2020, is the possibility of selling company shares without visiting a notary. Here’s a link to an article to read more about the transfer of shares of the Estonian company.

FAQ

How to get the e-Residency card?

You can apply for the e-Residency card by going to the official page of the program here: eresident.politsei.ee

What kind of business can I do with the Estonian company?

You can do all kinds of businesses, but it’s definitely better suited for online businesses selling digital products to get the benefits of doing everything digitally and remotely. E-commerce and selling physical products it’s fine as well, but there are more complex taxation matters involved, which sometimes can mean that using an Estonian company is not the most efficient way to do the business.

If your business is local, for example, a physical shop or real estate development, then it makes no sense to use the e-Residency company.

What are the benefits of e-Residency?

E-residency enables you to register and manage an Estonian company. As Estonia is part of the European Union, you will have access to the EU market, banking services and the entrepreneur community.

Everything is done online, including declaring your taxes and submitting the annual reports. It’s a cost-effective way to open and manage your business, coupled with the best taxation system in Europe.

How much does it cost?

The cost of the e-Residency card is 100€, and some delivery fees may be added depending on the pick-up location. Starting a company comes with additional fees, like 190€ state fee and fees for mandatory services like legal address, contact person and accounting.

Your monthly costs could be anywhere from 60€ per month to a few hundred euros per month, depending on the scale and nature of your business.

How long does it take to get the e-Residency card and register the company?

Application to get the e-Residency card takes around 30 minutes to one hour. Once you’ve submitted your application, it takes another 4 to 6 weeks to get the actual card delivered to your pick-up location. It can go faster, especially if you decide to pick up the card from Estonia, but it’s better to calculate in some buffer time.

Once you have the card, the company registration in Estonia takes 1-2 days and is a very quick process. Due to the COVID-19 pandemic, the delivery of the e-Residency cards is complicated, and there will be more convenient solutions in the near future.

Can I open a bank account?

Assuming that you’re not doing anything criminal and your background is clean, you can open a bank account or at least an IBAN account in a European fintech (banks also open IBAN accounts, so the result is the same).

You will have problems if the UBO or the company director is from a blacklisted country. This is an unfortunate issue, but the e-Residency can not change the fact that banks are not allowed to onboard clients from blacklisted jurisdictions. However, if a person holds a passport of a blacklisted country but resides in Europe, there’s a good chance to get the account opened.

How can I dissolve the company?

Dissolving the company is a long process and takes about eight months. In general, it’s not a complicated process, but just time-consuming. Currently, the parliament is discussing how to make it easier for e-residents and foreign entrepreneurs.

The first thing that you need to do is to appoint a liquidator. The liquidator will replace the management board member and will do all the necessary work. You can do the process by yourself as well, but it’s difficult without clear instructions.

If you hire a service provider, you will need to pay fees to the liquidator, and usually, the costs start from around 400€, but can be substantially more, if the company’s financial situation is complex, there are creditors, and in general, the business activity has been “unclear”.

We have a tutorial on how to appoint a liquidator to dissolve the company, which you can check out by clicking here.