Overview of Estonian (Financial) Licenses

In this article, we’re going to take a look at various different Estonian financial licenses.

One of the things that you’d like to avoid as a starting business is any sort of conflict with the authorities. Even more so in a foreign country, as you have a very little clue from where to get help from, and whether you are paying a fair price for that help, and so forth. That’s why it’s important to have a good entry point to any jurisdiction you’re going to – a solid advisor can save you a ton of trouble and money in the long run. It’s better to pay a reasonable price for a bit of good advice than to choose the cheapest option out there. Cheap means volume to make money, and volume means a factory-like service, where you’re not going to get any attention, thus no proper advice. The best advisors like challenges. They do not like processing clients and their needs like simple products on a factory production line.

If you’re getting started in Estonia, and you have a feeling it might be a field which requires licensing, it’s wise to make that sure. There are quite a few different licenses in Estonia, as there are anywhere, and it’s not always clear which license you will need. Sometimes authorities may have a different interpretation of your business and activities than you have or the lawyers you have hired have. If there’s no clarity, it’s not bad to communicate with the authorities before going into the licensing process. Below, we’ve outlined some of the more popular licenses we’re being asked for, and a short overview of the licenses and links to different sources where you can find more information. As always, we’re open to consult you on your needs and help you through the licensing process.

Virtual Currency Exchange license and e-wallet license

As the sub-headline already says, these licenses are usually obtained by the crypto exchanges. Estonia has issued quite a lot of these crypto licenses, though most of the companies are not operational or will not survive the competition due to lack of money, lack of competitive advantage, and many other reasons. The official names of the licenses are:1. Providers of a service of exchanging a virtual currency against a fiat currency 2. Providers of a virtual currency wallet serviceThe first one allows you to exchange fiat to crypto and crypto to fiat. Usually, crypto to crypto transactions do not require a license. The second license allows you to provide e-wallet services for virtual currencies. You can generate and keep encrypted keys on the behalf of the client, i.e providing custodial services of the required credentials to access the virtual currencies. If you’re opening a centralised exchange, you’re going to need both licenses.

Read more here and about new requirements here.

Financial Institution license

Financial Institution license, similarly to crypto licenses, is issued by the Estonian Financial Intelligence Unit, and has almost identical requirements during the application process. Financial Institution can do quite a few different things according to the Estonian regulations. Upon applying for the license, you’ll need to pick the activities from the following list:

– Central contact point designated by an e-money institution or a payment service provider– Fund manager– Savings and loan association– Provision of advice to clients– Borrowing and lending operations– Leasing transactions– Money brokerage– Guarantees and commitments– Currency exchange

There’s an important note to be made, however. Some of the activities, if they are the main activities of the company and the main turnover and business is generated through these activities, will need an additional license from the FSA (Financial Supervisory Authority) – it’s a different institution, and licenses issued by the FSA are generally harder to obtain. Lending operations provided to the consumers (not B2B) may require credit intermediary or credit institution license from the FSA. Fund manager activities will most likely require Fund Manager license, and so forth. There’s a lack of clarity when it comes to the Financial Institution License, and the Estonian Bar Association has addressed this in the past.

E-money Institution license

E-money institution under EMI Directive (Directive 2009/110/EC) is a business very similar to Payment Institution, but there’s a key differentiator. E-money institution (EMI) can issue electronic money (the digital equivalent of cash stored on an electronic device). EMI can do all the things the Payment Institution can do and is also is allowed to provide IBAN accounts, payment cards and e-wallets. Capital requirement is 350 000€. Revolut, TransferWise and N*26 are some of the known e-money institutions.

E-money Institution in Estonia.

Payment Institution license

Payment institution under PDS2 Directive (Directive 2015/2336/EU) offers services of execution of payment transactions, including credit transfers and direct debits, issuing or acquiring payment instruments, money remittances, foreign exchange services, and similar services. Payment Institution license is suitable for credit card processors, payment account operators, remittance businesses, foreign exchange businesses, payment initiation companies, and so forth. Capital requirement is 125 000€.

Payment Institutions and E-money Institutions.

Investment Firm license

Investment Firm License – read more.

If you plan to provide investment services in Estonia or in another state of the European Economic Area, you have to get an authorization. In Estonia, the institution that can issue such licenses/authorizations is Estonian Financial Supervision Authority (EFSA). Bear in mind that there are different investment services, and for each service you have to have an authorization. Hence, it’s good to have a thorough understanding of which services exactly are you going to provide for the clients. The good thing is that such authorization has an unspecified term, i.e you do not have to repeat the process after some time. If you should decide to apply for an authorisation, the Supervision Authority shall make a decision to grant or refuse to grant an authorisation within two months after receipt of all the necessary information and documents, but not later than within six months after receipt of the application for the authorisation.

Fund Manager license

The main and permanent work of a fund management company is to manage the assets of a fund established as a company or a contractual fund. A management company may manage several funds. Alongside fund management, the management company may provide the following services:

- managing a securities portfolio within the meaning of the Securities Markets Act;

- investment advice;

- holding fund units or shares for clients;

- fund management services within the meaning of the Investment Funds Act for funds whose assets it does not manage.

A licence is needed to operate as a fund manager, and this is issued and can be withdrawn by EFSA. A fund management company is a business whose main work is to manage investment funds or securities portfolios. Fund management means managing the issuance of a fund’s shares or units, deciding the investment of the fund’s assets, keeping accounts of the fund’s assets, and conducting other operations directly related to these activities. A management company may manage several funds. The operations of fund managers are regulated by the Investment Funds Act. The law requires public investment funds, including pension funds, to have an operating licence as a fund manager, and this is issued by EFSA.

Credit intermediary license

The credit intermediary facilitates the issuing of credit to consumers for a fee or enables consumers to sign credit agreements. The credit intermediary assists consumers before they sign a credit agreement or when they are signing it, and intermediates contracts on behalf of the creditor independently and permanently or signs them on behalf of and on the account of the creditor.

A mortgage intermediary mediates mortgage-backed credit to consumers.

The following data and documents should be submitted to Finantsinspektsioon with the application for an operating licence:

- the statutes of an applicant who is a legal entity or the name, place of residence, and personal ID code or date and place of birth if there is no ID code of an applicant who is a natural person;

- a business plan; for an applicant who is a legal entity, information on the members of the management board and supervisory board, including their first and family names, personal ID codes or date and place of birth if they have no ID code, place of residence, description of education, full list of jobs and positions held, and for members of the management board a list of their areas of responsibility, together with any documentation that the applicant wishes to submit demonstrating their trustworthiness and compliance with the Creditors and Credit Intermediaries Act;

- for an applicant who is a legal entity, documentation proving the existence of paid-in share or equity capital;

- the initial balance for an applicant who is a legal entity and the most recent balance and profit report of the applicant and annual reports for the past three years if they exist;

- an operating plan describing above all the planned services;

- the internal rules set out in § 44 of the Creditors and Credit Intermediaries Act, including the rate for the cost of credit with the basis for calculating the typical figure and the internal bookkeeping rules or proposals for them;

- a description of the information systems and other technological solutions needed for providing the planned services;

- a description of measures to ensure compliance with anti-money laundering and terrorist financing obligations and obligations for information about the payer to be sent when transferring money when issuing credit and financing the activities of the creditor; for an applicant who is a legal entity, a description of the organisational structure that if necessary includes a description of the use of credit intermediaries or related credit intermediaries or the procedure for transferring services; a list of the owners of an applicant who is a legal entity, showing their names, their registry code or ID code, or date and place of birth if they have none, and details on the share or equity holdings of each shareholder or member and the voting weight given to them;

- the data noted in § 31 of the Creditors and Credit Intermediaries Act on the major shareholders and controlling interests of an applicant who is a legal entity; data on any legal entity that the applicant or its management holds more than 20% of or over which they have control, where those data include the size of its own capital and equity, a list of its areas of activity, and the size of the holding of the applicant and each manager;

- information on the auditor and internal auditor of an applicant who is a legal entity, giving their names, places of residence or locations of operations, and personal ID codes or dates and places of birth or registry codes if there is no ID code; information on the auditor of an applicant who is a natural person, giving name, place of residence or location of operations, and personal ID code or date of birth or registry code if there is no ID code; information certifying that the managers and staff of the creditor have sufficient knowledge skills and experience;

- proof of payment for the processing fee noted in § 453(2) of the Financial Supervision Authority Act. The information required in point 12 on the major shareholders and controlling interests of an applicant does not need to be submitted when applying for an operating licence as a savings and loan association.

Credit institution license

The main job of a credit institution, or bank, is to take in deposits of money and other repayable funds from the public and to issue loans on its own account or to finance them in other ways. To create a credit institution, an activity licence needs to be applied for from the EFSA. Only businesses that take in deposits from the public have the right to use the name ‘bank’. The only businesses established in Estonia that are allowed to take in deposits from the public are those that have a licence from the EFSA to operate as a credit institution.

Insurance broker license

An insurance intermediary specialises in intermediating insurance contracts, and earns a fee for doing so. Insurance intermediaries in Estonia are divided into insurance brokers and insurance agents. The roles of an insurance broker and an insurance agent are fundamentally different, as an insurance broker represents the interests of the policyholder, while the agent represents the interests of the insurance company.

Insurance agents are listed under the insurance company that authorised their activity. The insurance company is responsible for the correctness of the entries in the list. For an insurance broker to be entered in the list of insurance intermediaries, an application must be submitted in writing to EFSA. The decision of whether to accept the entry in the list or to refuse it is taken by EFSA within one month after the documents and data required by law have been submitted. In reality, the process can take even 6 months.

Insurance company

An insurer, or an insurance company, is a business whose main activity is to compensate losses incurred or to pay out an agreed sum of money if an event occurs that is insured against. Insurance activity is when the insurer takes on the risks of the policyholder or insured party under an insurance contract. If an insured event occurs, the insurance company pays out compensation. The main types of insurance are non-life insurance and life insurance. In both non-life and life insurance, a contract is signed in order to hedge risks, while life insurance is also for collecting savings. A company needs to have a licence to engage in insurance activities and companies established in Estonia receive their operating licence from the EFSA.

The time limit for procedures:

The operating licence is issued once the data and documentation submitted to meet the requirements and show clearly that the applicant for a licence has sufficient means and organisational capacity for insurance activities and that the interests of the policyholders, the insured, and the beneficiaries are sufficiently protected. The decision to issue an operating licence or to refuse it is taken by the EFSA within three months after all the necessary documentation and data have been received and the requirements have been met, but not later than six months after the application for the operating licence has been received.

Travel Undertaking

A travel undertaking is an undertaking which operates with packages and linked travel arrangements for economic or professional purposes either as a tour operator, a travel retailer, or an undertaking facilitating the conclusion of contracts on linked travel arrangements.

A tour operator is a travel undertaking who combines packages and offers them or enters into package contracts itself or through another travel undertaking or together with them; as well as an undertaking who transmits the passenger’s data to another undertaking pursuant to clause 7 (2) 5) of the Tourism Act (transmission of passenger data to another undertaking if it is carried out on the linked online booking sites of different undertakings).

A travel retailer is a travel undertaking who offers packages combined by a tour operator or enters into package travel contracts on behalf of a tour operator. Travel retailers who offer packages combined by travel undertaking established outside the European Economic Area or enter into package travel contracts on behalf of the latter are subject to requirements provided by the Tourism Act for tour operators.

Before the start of their activities, the following travel undertakings must submit a notice of economic activities to the Register of Economic Activities:

- Tour operators;

- Travel retailers who offer packages combined by travel undertakings established outside the European Economic Area or conclude package contracts on behalf of the latter;

- Undertakings facilitating the conclusion of contracts on linked travel arrangements

Requirements for an applicant:

A tour operator shall provide security to fulfil the obligations listed in subsection 15 (3) of the Tourism Act in case the tour operator becomes unable to perform their obligation arising from the package travel contract due to their solvency. An undertaking facilitating the conclusion of contracts on linked travel arrangements must have security for fulfilling the obligations listed in subsection 15 (4) of the Tourism Act if the travel service that is part of the linked travel arrangement is not provided due to the undertaking’s solvency.

A travel undertaking’s security must be sufficient at all times for the fulfilment of the obligations listed in subsections 15 (3) and (4) of the Tourism Act and the travel undertaking is required to prove the existence and sufficiency of the security. The security may be a warranty or an insurance policy issued by an insurance company or credit or financial institution located either in Estonia or another member of the European Economic Area. The detailed requirements for the security are established in sections 15 and 151 of the Tourism Act.

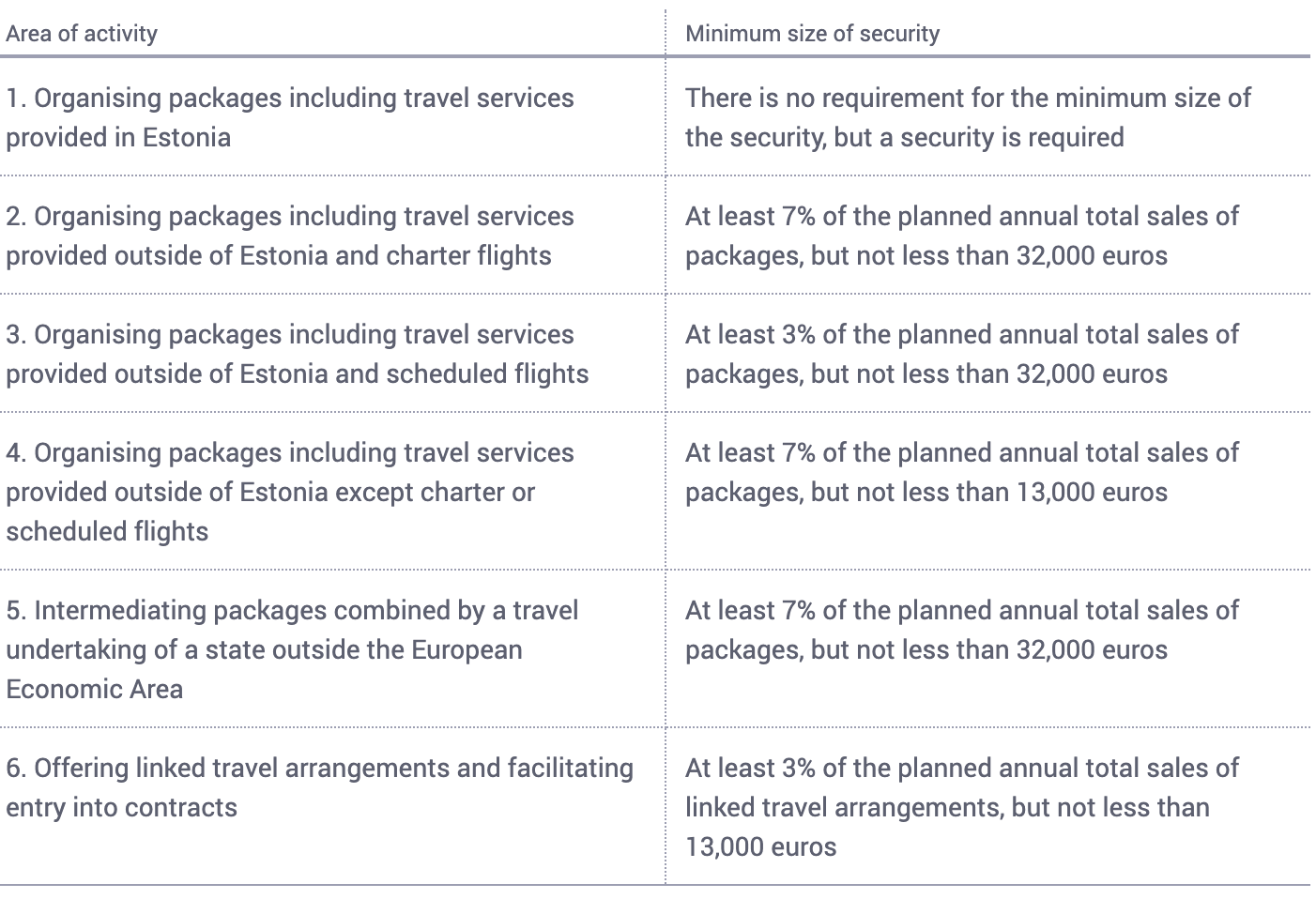

The table below specifies the minimum size for the security depending on the area of activity of the travel undertaking. The travel undertaking must analyse and assess the undertaken and arising obligations related to the sale of packages and linked travel arrangements to determine security which complies with the requirements of the law in accordance with their area of activity.

If a travel undertaking operates in several areas of activity requiring security, the security may not be smaller than is required for the area of activity with the largest security. The security is calculated on the basis of the travel undertaking’s total sales of the packages and linked travel arrangements in the previous calendar year if it is bigger than the travel undertaking’s planned annual total sales of packages and linked travel arrangements.

During its operation, the travel undertaking is required to assess the size of the security and, if necessary, increase it.

The total sales of packages and linked travel arrangements is the total amount of all payments by or on behalf of passengers made to the travel undertaking (including the travel retailer) for package travel contracts and linked travel arrangements contracts, including the amount received as prepayment and unused gift vouchers.

Please remember that this is not an all-inclusive list of licenses. If you have any doubts about whether you need an operating license in Estonia, write to us at hello@comistar.com