Investment Firm License in Estonia & Europe

Disclaimer: This post does not constitute legal advice and does not establish an attorney-client relationship.

We get a lot of inquiries from entrepreneurs who wish to register a company providing investment services. This is a licensed activity. Below, we try to give you an overview of registering such company in Estonia.

If you plan to provide investment services in Estonia or in another state of the European Economic Area, you have to get an authorization. In Estonia, the institution that can issue such licenses/authorizations is Estonian Financial Supervision Authority (EFSA). Bear in mind that there are different investment services, and for each service you have to have an authorization. Hence, it’s good to have a thorough understanding of which services exactly are you going to provide for the clients. The good thing is that such authorization has an unspecified term, i.e you do not have to repeat the process after some time. If you should decide to apply for an authorisation, the Supervision Authority shall make a decision to grant or refuse to grant an authorisation within two months after receipt of all the necessary information and documents, but not later than within six months after receipt of the application for the authorisation.

You may lose the authorization though – if the company will be dissolved, license revoked by the EFSA, or when investment firms merge and the company holding the license is being acquired, or in the case of a bankruptcy.

Services which the Investment Firm can provide

As an investment firm you may provide following investment services and activities:

1) reception and transmission of orders related to securities;

2) execution of orders related to securities in the name of or for the account of the client;

3) dealing in securities on own account;

4) securities portfolio management;

5) provision of investment advice;

6) guarantee of securities or guarantee of the offer, issue or sale of securities;

7) organising an offer or issue of securities;

8) operation of a multilateral trading facility;

9) operation of an organised trading facility.

As an ancillary services to investment services you may provide:

1) safekeeping and administration of securities for a client and activities related thereto, including receipt of securities transfer and pledge orders and other orders related to the encumbrance of financial securities from clients and forwarding or execution thereof;

2) grant of a credit or loan to an investor to conduct securities transactions on the condition that the creditor or lender itself is related to the transaction;

3) provision of advice to undertakings on capital structure, business strategy and related matters and advice and service relating to mergers of undertakings and participation therein;

4) provision of foreign exchange services where these are connected with the provision of investment services;

5) preparation or provision of recommendations on investment and financial analysis or other general recommendations in connection with securities transactions;

6) services related to the guarantee of the offer or issue of securities;

7) other investment services and ancillary services.

Documents and requirements

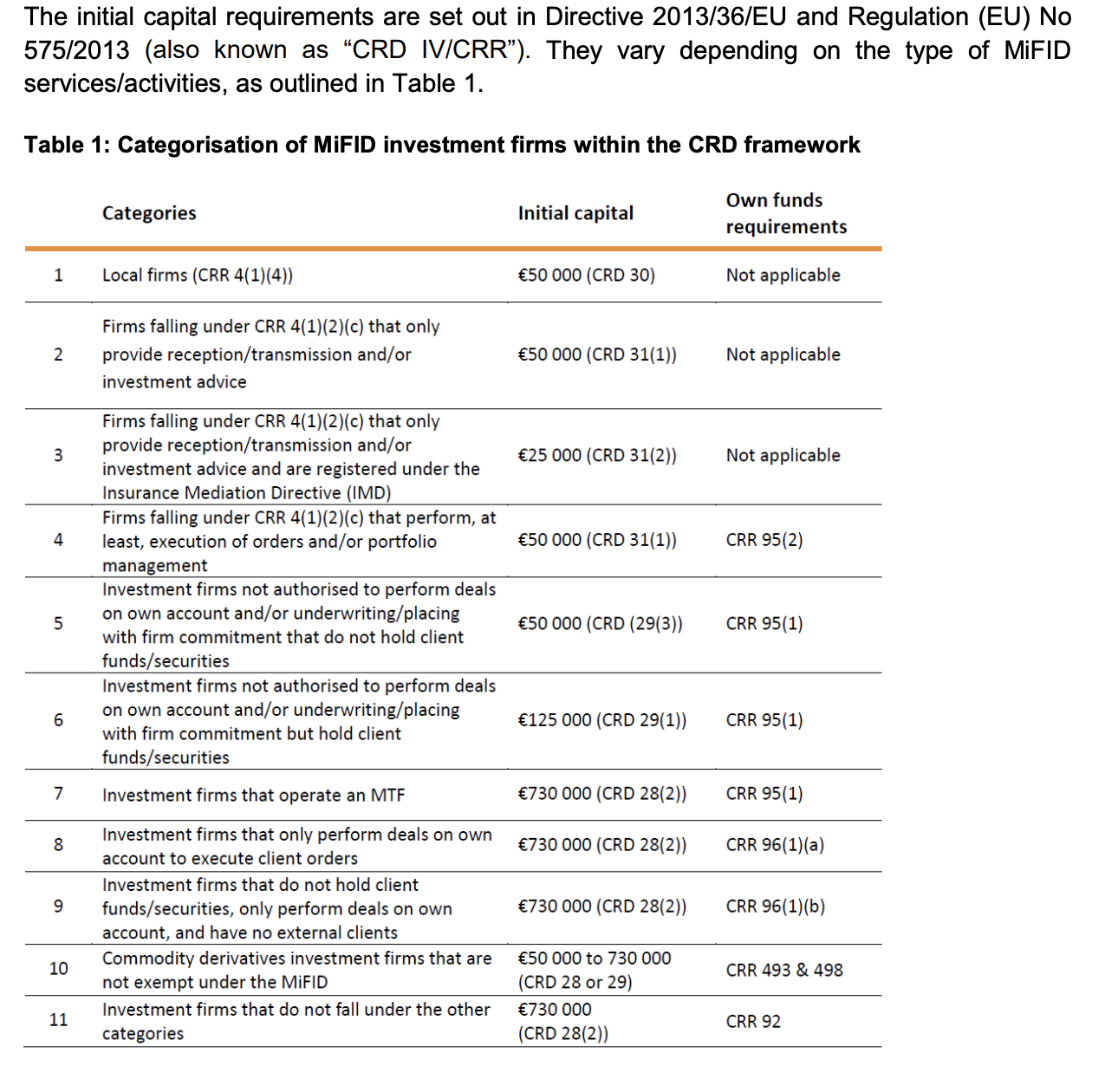

To be an investment firm and apply for the relevant licenses you have to register a public limited company (AS). The share capital has to be minimum 50, 000 euros or up to 730,000 euros, depending on the services the firm is providing. There are requirements for the shareholders and managers as well.

The description of a shareholder as an excerpt from the law: who has impeccable business reputation and whose activities in connection with the acquisition comply with the principles of sound and prudent management of the investment firm; who after the acquisition or increase of the holding shall elect, appoint or designate only such persons as managers of the investment firm which comply with the requirements provided for in the applicable law; whose financial situation is sufficiently secure to ensure regular and reliable operation of the investment firm, and in the case of a legal person if such financial statements exist, they allow for a correct assessment to be made of its financial situation; who is able to ensure that the investment firm is able to meet the prudential requirements, in the case of a legal person above all the requirement that the consolidation group, which part the investment firm will form, has a structure which enables exercise of efficient supervision, exchange of information and co-operation between the financial supervision authorities; with regard to whom there is no justified reason to believe that the acquisition, holding or increase of a holding in or control over the investment firm is related to money laundering or terrorist financing or an attempt thereof or increases such risks.

Briefly put, the shareholders have to be a decent and diligent natural or legal persons.

Additionally, here’s a list of documents that have to be submitted with the EFSA:

– upon foundation of a company, a notarised transcript of the memorandum of association or foundation resolution;

– a copy of the articles of association and, in the case of an operating company, the resolution of the general meeting on amendment of the articles of association, and the amended text of the articles of association;

– a list of the shareholders of the applicant which sets out the name and the personal identification code or registry code of each shareholder, or the date of birth in the absence of a personal identification code or registry code, and information on the number of shares and votes to be acquired or owned by each shareholder;

– information relating to shareholders and other persons, with a qualifying holding in the applicant and information relating to the relationship with an investment firm, credit institution, insurance undertaking or other person subject to financial supervision authorised in a Contracting State;

– information on the members of the applicant’s managers, including, for each person, the name and surname, personal identification code or, in the absence thereof, date and place of birth, educational background, a complete list of places of employment and positions held during the last five years and, for the members of the board of management, a description of their areas of responsibility and other documents certifying the managers’ trustworthiness and conformity to the requirements of the Securities Market Act which the applicant deems necessary to submit;

– information on companies in which the holding of the applicant or its manager exceeds 20 per cent, which also sets out the amount of share capital, a list of the areas of activity and the size of the holding of the applicant and each manager;

– information on the auditor and person(s) conducting the internal audit of the applicant, including the name, residence or registered office, personal identification code or, in the absence of the personal identification code, the date of birth or registry code;

– the opening balance sheet of the applicant and an overview of the revenue and expenditure of the applicant or, in the case of an operating company, the balance sheet and income statement as at the end of the month prior to submission of the application and, if they exist, the last three annual reports;

– in the case of an operating company, documents certifying the amount of own funds together with the sworn auditor’s reports;

– if a credit institution, management company, investment fund, investment firm, insurance undertaking or another person subject to financial supervision of a third country has a qualifying holding in the applicant, confirmation from the supervision authority of the appropriate state to the effect that the specified person of a third country holds a valid authorisation and, according to the knowledge of the supervision authority, its activities are not contrary to legislation in force;

– the applicant’s three-year business plan which sets out at least a description of the applicant’s planned activities, organisational structure, places of business, information systems and other technical facilities, and a description of its economic indicators;

– the accounting policies and procedures and the internal policies

– the rules of procedure specified in subsection 14 (1) of the Money Laundering and Terrorist Financing Prevention Act and the internal audit rules to monitor compliance therewith;

– a document by which the applicant assumes the obligation to pay the single contribution to the Investor Protection Sectoral Fund prescribed in the Guarantee Fund Act;

– certification to the Supervision Authority concerning payment of the administrative fee.

– An applicant or manager of an investment firm shall be a member of the supervisory board and management board. The Supervision Authority may consider an employee of an applicant or investment firm or any other person who makes independent management decisions concerning the development or business of the applicant or investment firm as manager.

Capital Requirement table

Where you can provide the services?

An investment firm established and holding authorisation in Estonia may provide investment services or ancillary services abroad by the establishment of a branch, by the use of an investment agent or by the provision of services on a cross-border basis.

Conclusion

As you can see, it’s not as easy to start a company and provide investment services. There’s a barrier to entry, and with a good reason – everyone who want to operate with and invest other people money, they better have the required skills, integrity, and reputation to do so. And people that have what it takes, it will not be a problem to go through the necessary procedures.