Initial Coin Offering (ICO): What It Is and How It Works

An initial coin offering (ICO) is an easy way for startups to raise capital. It's also a way for anyone to invest or start a company.

Sounds easy?

Well, there's more you need to know about the intricacies of these funds. Here's everything you need to know about initial coin offerings and how they work.

What is an Initial Coin Offering (ICO)?

An initial coin offering allows anyone to raise funds without giving up their equity. Investors will be putting money into blockchain startups instead of the stock market.

It helps startups bypass the regulations of banks and venture capitalists, allowing almost anyone to start their own company or project.

The cryptocurrency used by ICOs can also be referred to as token sale or token funding.

It's one of the EASIEST ways for a burgeoning company to secure the funds they need to get started.

Brief History of ICOs

ICO started in 2013 when a software engineer named J.R. Willet wrote The Second Bitcoin White Paper, which raised around $600,000.

In 2014, more projects were started along with Ethereum, which became an extremely successful ICO.

The 50 million Ether tokens created were able to raise $18 million.

However, in 2016, a series of ICO tokens were found to be fraudulent or easily hacked, taking the example of the DAO project.

The lack of regulation had made it difficult for them to be correctly tracked and protected by authorities.

The year 2017 was the peak of the ICO movement, especially with the technological advancements during this period.

It was easier to sell the utility tokens, making them sell out in shorter periods.

The utility token ICO was one of the easiest ways for companies to bypass regulations, making it very popular with early investors.

Initial Coin Offering (ICO) Examples

Over the years, many ICOs have popped up for investors to consider. There have been many success stories over the years since its launch.

However, other ICOs might not be so lucky, from company failure to scams and fraud.

Here are some of the best examples of ICO tokens over the years.

Ethereum

It's one of the most successful ICOs in the industry, becoming the second-largest digital currency next to Bitcoin.

In July 2014 alone, they raised a capital of $18.4 million.

The Ether token reached an all-time high in 2021 at $4,382.73 per token, more than a whopping 1.4 million percent return on investment from the initial $0.311 per token sold.

Cardano

The Cardano is known to be the improved version of Ethereum, which was more successful as an ICO.

Thanks to market capitalization, its tokens were so successful that they could break into the TOP FIVE cryptocurrencies.

Dragon Coins

Dragon coins is an example of one of the many failed ICOs on the market.

It had a series of controversies back in 2018 after they were able to raise around $320 million, making its price drop once it became available to the public.

As of 2021, its capitalization fell to below $1 million.

Types of Initial Coin Offerings (ICOs)

ICO can be divided into two, private and public. It affects how they have their tokens sold to investors.

With the rise of existing cryptocurrencies and blockchain technology, ICOs have become popular and in demand with startups and existing businesses.

With that comes the various ways to generate the money raised for projects. These are the differences between those two types.

Private ICO

A private ICO only sells its tokens to accredited and limited investors. These are usually financial institutions and high-net-worth individuals who the company trusts.

There is a set minimum investment amount for investors to pay to get their tokens.

Public ICO

This type is open to investors from the general public, letting almost anyone into the project.

Its nature makes it less favored, mainly because of the regulatory concerns surrounding ICOs. It's even less secure, which can be a serious legal headache!

Legal Status of Initial Coin Offerings

Despite its significant impact on cryptocurrency, ICO is still heavily scrutinized, especially regarding the legality of token sales.

For example, in 2018, the U.S. Securities and Exchange Commission filed a case against the co-founders of Centra Tech for the fraudulent sale of tokens despite being endorsed by celebrities.

They've also filed a similar case against Ripple Labs.

Hence, the SEC released a statement to warn companies that if their digital assets involve security characteristics, like ownership rights and income streams, they should still abide by the security laws in place following the DAO Project's failure.

Countries such as South Korea, China, Ecuador, Macedonia, and more have banned investment in ICO.

Financial regulators from the UK, Australia, and more have warned about ICOs.

On the other hand, Canada, the US, and European countries are working to create specific regulations on ICOs to protect future investors.

Countries like New Zealand and the UAE have already released some guidelines.

How Do Initial Coin Offerings Work?

When a company decides to have one, it will have to announce the date of the ICO, its rules, and buying process.

Investors may need existing cryptocurrency wallets or fiat currency to purchase a token. An ICO can have the following setups when it comes to supply and price:

- Static supply/Static price: There are a fixed number of tokens and prices that the company sets beforehand.

- Static supply/Dynamic price: The company sets a specific number of tokens, but the selling price can change depending on how many will invest, raising prices as needed.

- Dynamic supply/Static price: There is a set price but no limit on how many tokens the company will sell.

Finding a new cryptocurrency is easy because of the low entry barrier. Almost anyone can start these up.

How Do You Start Your Own ICO Campaign?

Like most cryptocurrency projects, creating an ICO campaign requires a dedicated team and proper management.

These are the steps to starting your campaign:

- Identifying investment targets: The company creates the necessary materials to inform potential investors about their project and how they intend to raise capital.

- Creation of tokens: These representations of your investors' assets are modifications of already existing cryptocurrencies.

- Promotion campaign: During this time, the company contacts potential investors to inform them about their project.

- Initial token offerings: The tokens are offered to the investors, and the company launches its new project.

How are ICOs Regulated?

This type of venture capital is still relatively new.

However, its impact on cryptocurrency has made it popular among investors, especially since it's an easy way to raise funds.

Currently there are little to no regulations specifically for ICOs.

While some countries have started to impose bans, others are working to create regulations that can help protect the interests of both startups and investors.

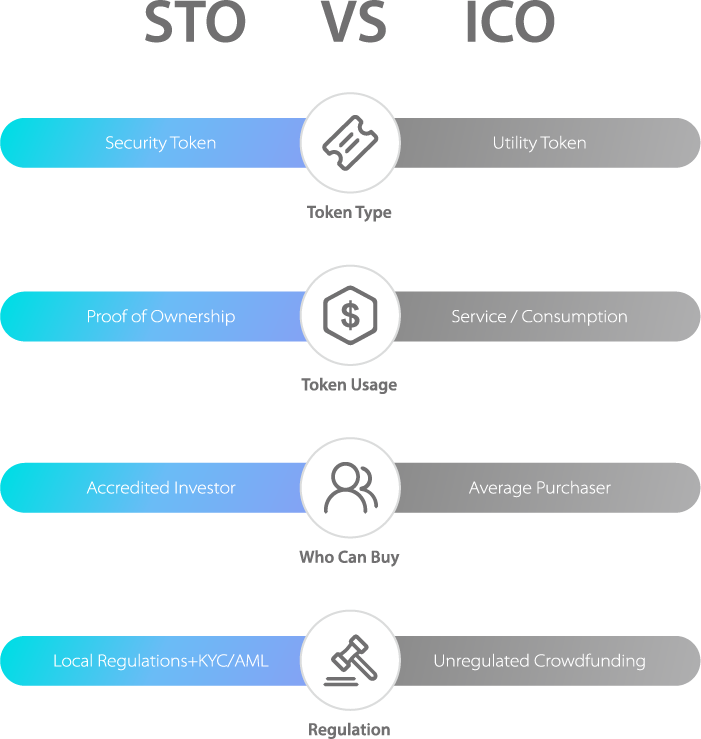

What are the Differences Between ICOs and IPOs

ICOs tend to be compared to an Initial Public Offering because of their nature. They both allow companies to raise money for a project.

However, they have factors that make them different from each other.

An initial public offering has stricter regulations than an ICO because investors put their money into securities.

The company must follow the regulations and are required to declare their potential risk factors and financial statements.

On the other hand, ICOs aren't supposed to sell securities, theoretically making them exempt from the laws in place and largely unregulated.

If an ICO is found to have been selling tokens that fall under the jurisdiction, it can face serious legal problems.

As a result, IPOs tend to be safer. If you're overwhelmed by ICO, investing in the IPO stock market is best.

Benefits and Risks of Initial Coin Offerings (ICOs)

Now that you know more about ICOs, you might wonder if they're for you and your business.

Take note of the following benefits and risks when considering an initial coin offering for your company.

Benefits

- It's very accessible, with almost no restrictions on who can invest.

- If you determine which cryptocurrency is a good investment, you can get high profits at a low price.

- It's a very efficient way to raise money for startups.

Risks

- The crypto space is highly volatile, and it's easy for tokens to lose their value, fail, or have the company run-off.

- You need prior knowledge of the crypto industry because it's more in-depth.

- The lack of regulation means many mediocre and scam ICOs don't have protection for their investors.

Frequently Asked Questions

You may have more questions on how an initial coin offering works. We've gathered the most common questions to help you further understand them.

How Can I Find a Good Cryptocurrency Project?

It's best to exercise extreme caution when considering investing in tokens and any upcoming ICOs.

Take note of the following when reviewing a project:

- Experience in setting up successful businesses and social media to contact them

- How the service or project works and the features they'll launch

- If a third party audits their computer code for security

- If there are any typos or signs that their website may be launched in a rush or with little thought

How Do Laws Affect Token Sales?

The main concern for tokens sold is security, with risks of fraud and manipulation.

Every ICO is unique and should be assessed on its own characteristics, so it's best to know if your ICO will fall under the securities laws by consulting an experienced attorney before launch.

Conclusion

Investing in an ICO is a game of risk and reward. Coins and tokens will amount to real cash that can grow or lose value.

Knowing what you'll need to exchange to get the appropriate financial return on these investments is best.

For more information and legal help, please contact us.