How to obtain a VAT number – 2022 Tutorial

Most Estonian e-Residency companies need to have the VAT number sooner or later. At Comistar, we take care of the application for you once you’ve appointed our accountants to represent your company at the Estonian tax office. You can find the tutorial to appointing an accountant to your Estonian company by clicking here.

In this tutorial, we’ll go through the updated process of applying for the Estonian VAT number.

STEP 1: Go to the tax office website

That’s pretty easy – just click here. You choose the preferred language in the top right-hand corner. Once this is done, click on the enter e-MTA button. It’s a blue button and a hard one to miss.

STEP 2: Log-in to the e-tax office

You can use your e-Residency card or SMART-ID (if you have it) to log-in to the e-tax office.

STEP 3: Select a represented person

Once you’re logged in, you can see the navigation bar on the left. On top of that navigation bar, there’s a button called “Select a represented person”. Click on that and choose your company name.

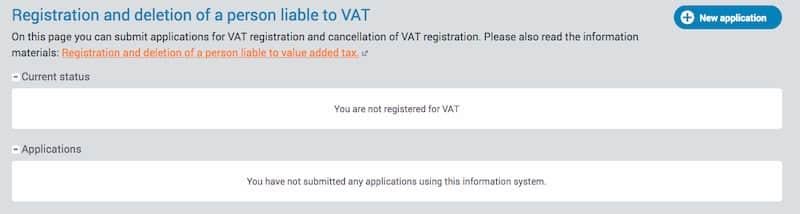

STEP4: Registers and Inquiries (for VAT application)

Once you’ve selected the represented person, i.e your company, then you’ll see a button “Registers and inquiries” on the left navigation bar. Once you click on that button, you will see different options, such as “Registration of employment”, “Registration of VAT liable person“, etc. The “Registration of VAT liable person” is the next button that you need to click on.

STEP 5: Apply and obtain the VAT number.

Now you can start the VAT application by clicking on the blue button “New Application”.

Once you click on the “New Application” button, you will be presented with two options. It’s very likely that you need to choose the first one – “Register as a person liable for VAT“. The second option is for special cases, and your accountant shall advise you to choose the second option if your business requires a VAT number with limited liability. 99% of the time this is not the case.

STEP 6: Fill in and submit the VAT application

You will now see the VAT application which you need to fill in and submit. It’s not difficult, but you’ll need to describe your business activities (rather write more than less), and choose whether you’re applying voluntarily or your business turnover has exceeded 40 000€ in a calendar year. You will be also asked to supplement any documents that prove the business activity (if you have any).

How long time does it take to get the VAT number?

In 95% of cases, the VAT is issued automatically if it’s done by an accountant or by your service provider. In other cases when you apply it the tax-office could ask for additional documents such as bank account statements, sales invoices and questions, regards who is handling the accounting and about the company. The standard timeframe for obtaining the VAT number is set by law, which is 5 business days.

If you have any questions or you’d like to subscribe to our Zero to Scale platform (which includes accounting), get in touch with us.