How To Fill In W8-BEN Form (e-Residency)?

This article is meant for e-residents dealing with the US and needing to fill in the W8-BEN form.It’s a guideline, and while it’s not very simple to read, I hope it’s still helpful.

How to fill out the W8-BEN form?

A W-8BEN, Certificate of Foreign Status of Beneficial Owner for U.S. Tax Withholding, form is used by foreign individuals who acquire various types of income from U.S. sources. For example, you can claim a US tax reduction for you on your dividends and interest from US shares.

The US has an income tax treaty and forms W8-BEN will establish your eligibility for treaty benefits. The purpose of the form is to show:

- The individual in question is the beneficial owner of the income connected to Form W-8BEN.

- That an individual is a foreign person (technically a non-resident alien) and not a U.S. citizen.

- The individual is eligible for a reduced tax withholding rate or is exempt entirely due to an income tax treaty between his home country and the United States.

America’s tax authority publishes all of its forms at http://www.irs.gov/. Link to fillable W8-BEN form for business entities.

Follow the instructions on how to fill out a form from here:

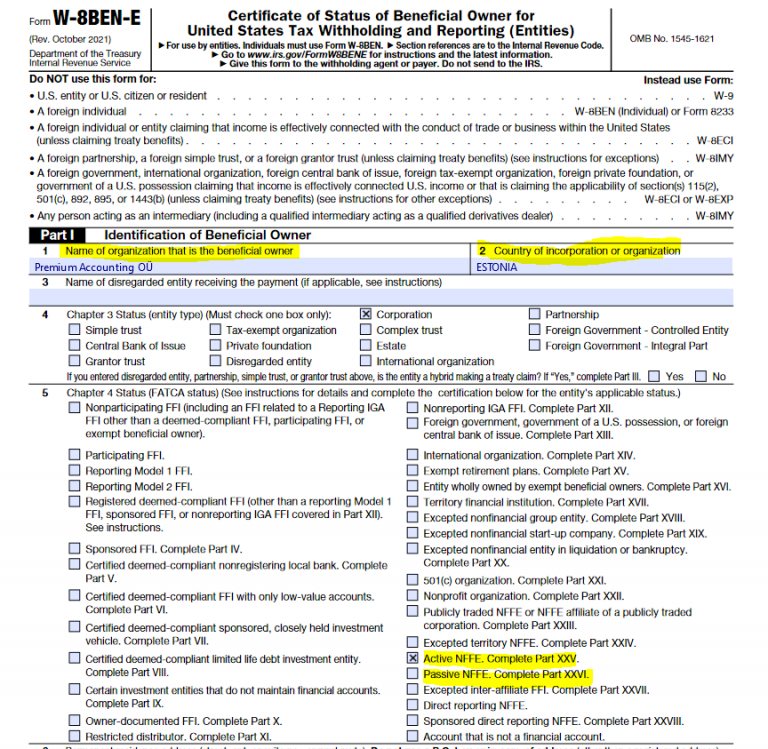

- Enter the full name of the entity that is the beneficial owner.

- Check only one box that suits your entity type.

- Check only one box that applies to your FATCA status. Complete the additional part of this form as indicated next to the checked status.

- An Active NFFE is a non-U.S. entity that is not a financial institution*, and it meets at least one of the below criteria:

- less than 50% of its gross income is passive income, and less than 50% of the assets held to produce passive income**;

- All activities consist of holding participation in, or providing financing and services to, subsidiaries engaged in business other than of financial institution, except investment funds or other investment vehicles whose purpose is to acquire and then hold interests in companies as capital assets for investment purposes;

- within 24 months after incorporation, is not yet running a business and has no prior operating history but is investing capital into assets with the intent to run a business other than that of a financial institution;

- it engages in financing and hedging transactions with, or for, related entities that are not financial institutions and the group is not primarily engaged in a financial institution’s business.

*For FATCA purposes, the following entities are considered a financial institution:– a depository institution is an entity that accepts deposits in theordinary course of a banking or similar business;– a custodial institution is an entity that holds, as a substantial portion of its business, financial assets on behalf of others (i.e. the gross income attributable to such business exceeds 20% of its gross income for the previous three year accounting period);– an investment entity is an entity that offers the services of trading in financial instruments, individual or collective portfolio management or other services relating to investment, administering or managing funds or money to its customers as a business;– an insurance company.** Passive income includes dividends, interest, rents, royalties, annuities, and other forms of passive income.

- A non-US entity is not a financial institution* and does not classify as an active NFFE (see above). This generally includes entities with mainly passive income (no operational business). Passive income includes dividends, interest, rents, royalties, annuities, and other forms of passive income.

*For FATCA purposes, the following entities are considered a financial institution:– a depository institution is an entity that accepts deposits in the ordinary course of a banking or similar business;– a custodial institution is an entity that holds, as a substantial a portion of its business, financial assets on behalf of others (i.e. the gross income attributable to such business exceeds 20% of its gross income for the previous three year accounting period);– an investment entity is an entity that offers the services of trading in financial instruments, individual or collective portfolio management or other services relating to investment, administering or managing funds or money to its customers as a business;– an insurance company.

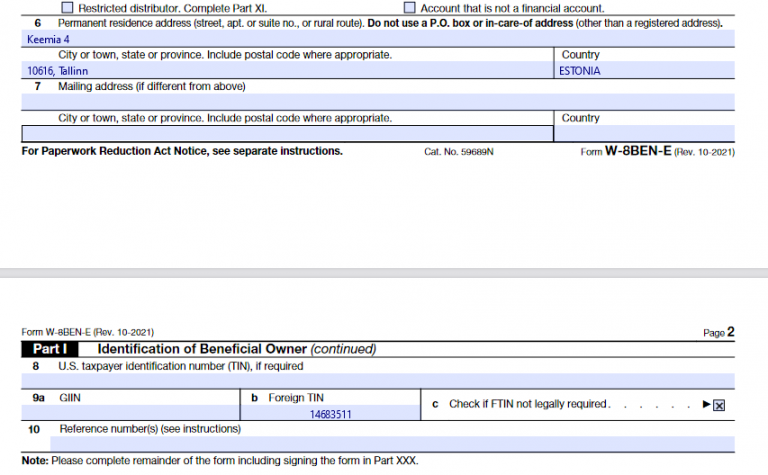

- Give registered address.

- In the case of an Estonian entity, insert your company’s registry code from the commercial register. Provide only if you have to obtain GIIN (e.g. reporting Model 1 FFI, direct reporting NFFE, sponsored direct reporting NFFE).

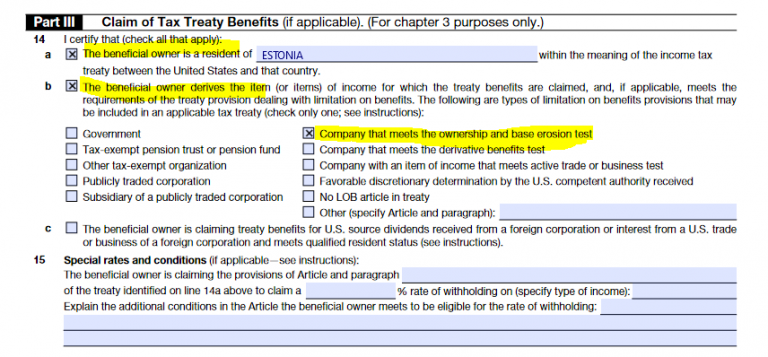

- Enter the company’s country of tax residency and check the applicable tax treaty provision under which you claim the reduced tax rate. If the company is a tax resident of Estonia*, enter „ESTONIA“ in paragraph 14. a, put a checkmark in paragraph 14. b and tick the „Company that meets the ownership and base erosion test“ box.

*To qualify for classification as a tax resident of Estonia, a company must meet the requirements set out in Article 22 of the tax treaty between Estonia and the USA.The text of the aforementioned tax treaty can be found on the Internal Revenue Service website: irs.gov/pub/irs-trty/estonia

- Check the box to verify that you meet all the requirements for this status, including the assets and passive income test described in the certification part. Passive income includes dividends, interest, rents, royalties, annuities, and other forms of passive income.

- Check the box to verify your status as an Active/Passive NFFE.

- If your circumstances change, a new form must be provided within 30 days.

- The form has to be signed by a duly authorised representative of the entity.

- Give your full name here in CAPITAL LETTERS.

- Provide the date of signing*.

- The date needs to be in the exact format (MM-DD-YYYY)

For additional instructions on how to fill out the form, please see IRS instructions available athttp://www.irs.gov/uac/About-Form-W-8BEN-E.

If you have any doubts or questions on how to fill out the W8 form, feel free to get in touch.